Full Coverage Car Insurance Explained Clearly

Driving without the right insurance can leave you vulnerable. Full coverage car insurance sounds like complete protection for your vehicle, but what does it really include? In this guide, you’ll find Full Coverage Car Insurance Explained Clearly, cutting through the jargon so you know exactly what “full coverage” means, how it works, and whether you need it. We’ll explore full coverage vs. liability only policies, discuss full coverage car insurance quotes and costs, and offer tips especially for new drivers and teens on getting the best value. By the end, you’ll understand the full coverage car insurance benefits and be equipped to make an informed decision about your policy.

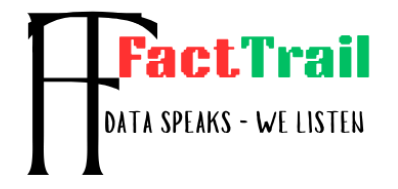

What Is Full Coverage Car Insurance?

Full coverage car insurance isn’t actually a specific policy type, it’s a convenient term that refers to a combination of coverages. In fact, “full coverage” is just a common nickname for a policy that bundles three key protections: liability, comprehensive, and collision. In other words, when you have “full coverage,” you carry the state required liability insurance plus coverage for damage to your own car through collision and comprehensive insurance. Keep in mind, asking for “full coverage” doesn’t mean everything imaginable is covered but it does protect you against most common risks on the road.

Here’s what full coverage typically includes:

- Liability Coverage: Pays for injuries or property damage you cause to others in an accident.

- Collision Coverage: Pays to repair or replace your own car if it’s damaged in a collision , regardless of who is at fault.

- Comprehensive Coverage: Pays for damage to your car from non collision events, theft, vandalism, fire, natural disasters, hitting an animal, etc.

Together, these three coverages give you a broad safety net. Liability takes care of others’ damages, while collision and comprehensive take care of your car. That’s why lenders or leasing companies often require full coverage if you finance or lease a vehicle, it protects their interest in the car. However, even if it’s not required, full coverage can be a smart choice for many drivers who want peace of mind.

Now that we have full coverage car insurance explained clearly, let’s look at why you might want it and how it compares to basic liability coverage.

Benefits of Full Coverage Car Insurance

Why pay more for full coverage? Simply put, it provides greater financial protection for you and your vehicle. Here are some key full coverage car insurance benefits to consider:

- Protection for Your Vehicle: Unlike liability only insurance, full coverage will pay to fix or replace your car after an accident or other covered incident. This is crucial if you have a newer or expensive car that would be costly to repair out of pocket.

- Peace of Mind: With collision and comprehensive included, you’re covered against a wide range of mishaps , from fender benders to a tree falling on your car. You can drive knowing an unexpected event won’t wreak havoc on your finances.

- Lender Requirements: If your car is financed or leased, the lender will usually mandate full coverage. This ensures the car is protected until you pay it off.

- Avoiding Major Out of Pocket Costs: Full coverage can save you from paying tens of thousands in the event of a serious accident or a total loss. For example, repairing modern vehicles after a crash or replacing a stolen car can be extremely expensive, full coverage handles those costs .

- Additional Perks: Full coverage policies often allow adding extras like roadside assistance, rental car reimbursement, or uninsured motorist coverage for even more protection. These options help tailor your policy to your needs.

Insurance experts often advise full coverage if you couldn’t easily afford to replace your car in a worst case scenario. If you have a loan, a newer car, or limited savings, the added protection is considered a wise investment. On the other hand, if your car is old and not worth much, full coverage might not be cost effective . The bottom line is that full coverage provides a high level of security for you as a driver, which can be well worth the slightly higher premium.

Full Coverage Car Insurance vs. Liability

One common question is full coverage car insurance vs. liability, what’s the difference, and is the extra coverage worth the cost? The difference comes down to what’s covered and who it protects:

- Liability Only Insurance: Covers other people’s injuries and property damage if you cause an accident. It’s the minimum coverage required to drive legally in most states. Liability insurance does not pay for any damage to your own car or your injuries in an at fault accident. If you only carry liability, your insurer will pay for the other driver’s car repairs and medical bills up to your policy limits but you’re on your own when it comes to your vehicle. This is a budget option that meets legal requirements, but it leaves you exposed to large bills to fix or replace your car.

- Full Coverage Insurance: Includes liability coverage plus protection for your vehicle, collision & comprehensive. This means if you crash into someone or something, your policy can pay to repair your car. If a hailstorm dents your hood or a thief steals your car, comprehensive coverage steps in. Essentially, full coverage adds first party protection for the policyholder’s car on top of the third party liability coverage. As a result, full coverage is more expensive than liability only insurance because it offers more robust protection.

To illustrate the cost difference, consider this: full coverage car insurance costs an average of $2,697 per year in the U.S., while minimum liability coverage averages about $820 per year. That’s roughly three times more in price for full coverage. The higher premium reflects the added benefits, you’re insuring your own vehicle against damage, not just liability to others. For many drivers, that extra cost is worth it for the peace of mind and financial safeguard. But if your car is very inexpensive, you might decide to forego collision and comprehensive to save money. A good rule of thumb: if the annual cost of full coverage exceeds 10% of your car’s value, it may not be worth it.

In summary, liability insurance is cheaper and covers only the other party’s damages, whereas full coverage costs more but covers your car as well. If you want the security of knowing your own vehicle is protected in an accident or mishap, full coverage is the better choice. If you’re driving an old beater worth only a few thousand dollars, sticking with liability might be a reasonable gamble to save on premiums.

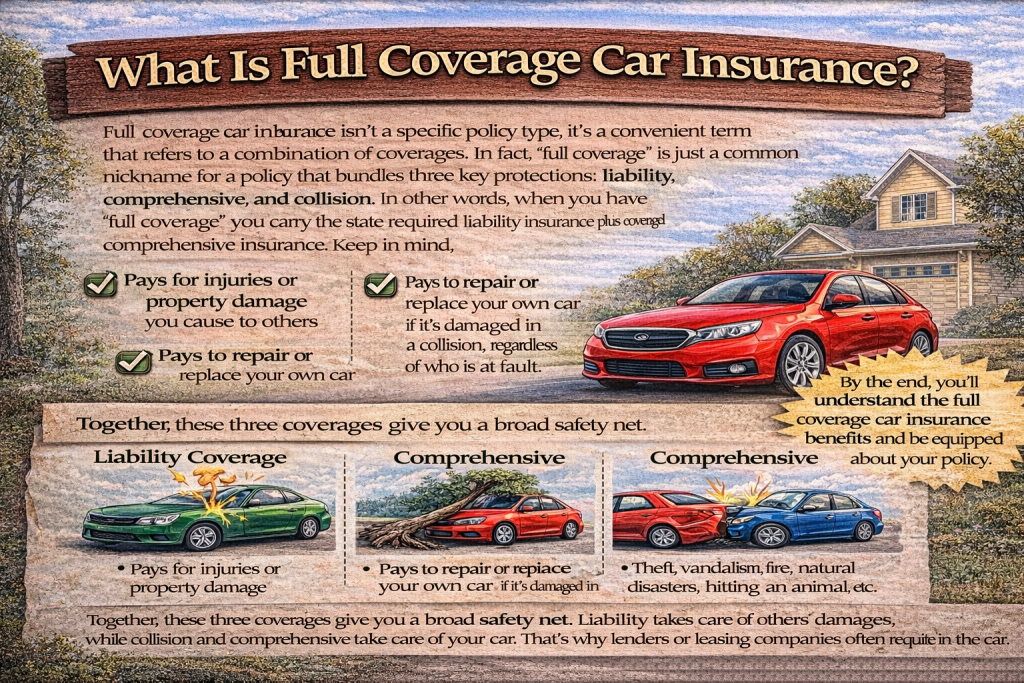

How Much Does Full Coverage Car Insurance Cost?

When it comes to full coverage car insurance cost, there isn’t a one size fits all price. Premiums can vary dramatically based on individual factors. As mentioned, the national average for a full coverage policy is around $2,697 per year about $225 per month, but your actual rate could be quite different. Some drivers pay under $1,500 a year, while others pay over $3,000. It all depends on the risk factors and coverage choices. Key elements that influence the cost of full coverage include:

- Driver’s Age & Experience: Younger and less experienced drivers pay more. For example, a teenager’s full coverage premium can be several times higher than a 40 year old’s due to higher accident risk .

- Driving Record: A clean record with no accidents or tickets will get you a better rate. Multiple accidents or violations make you high risk, raising your liability and collision premiums.

- Location: Insurance costs vary by state and even ZIP code. If you live in an area with heavy traffic, high accident rates, theft, or extreme weather, full coverage will cost more. For instance, the average annual full coverage premium in low cost states like Idaho is around $1,476, whereas in high cost states like Florida it’s about $3,884

- Vehicle Make and Model: The car you drive is a big factor. A luxury SUV or sports car will typically cost more to insure than an older sedan. Expensive cars mean expensive repairs or replacement, leading to higher comprehensive and collision rates. Cars with advanced safety features, on the other hand, might get discounts.

- Coverage Limits & Deductibles: Choosing higher liability limits or low deductibles, the amount you pay out of pocket for a claim will increase your premium. You can reduce your full coverage cost by opting for a higher deductible that you could comfortably afford if you needed to file a claim.

- Credit History: In most U.S. states , insurance companies consider your credit score. Drivers with poor credit tend to be charged more, as statistics link lower credit to higher claim rates.

- Annual Mileage and Usage: The more you drive, the greater your chances of an accident. Long commutes or rideshare can raise your premium. Conversely, low mileage drivers might get a discount.

Because so many factors are at play, it’s wise to compare full coverage car insurance quotes from multiple insurers. Each company weighs these factors differently. By shopping around, you might find a company that offers a much better rate for your particular profile. Many insurers offer online quote tools where you can input your information and quickly see rates. You can also work with an independent insurance agent to get quotes and advice on adjusting coverages to fit your budget.

Full Coverage Car Insurance for New Drivers and Teens

If you’re a newly licensed driver or the parent of one, you’re probably curious or concerned about full coverage car insurance for new drivers and teens. Insurance for young drivers is notoriously expensive because of their higher accident rates. In fact, adding a teen driver can skyrocket your premiums. For example, the average cost of insuring a 16 year old with full coverage on their own policy is about $9,825 per year, whereas adding a teen to a parent’s policy costs roughly $4,515 per year . Teen and new drivers pay more due to lack of experience, statistically, they’re more likely to be involved in crashes.

So, should new drivers carry full coverage? Here are a few points to consider:

- Vehicle Value: If a teen or new driver is driving an older, inexpensive car, some families opt for liability only to save money. On the other hand, if it’s a newer car or one with a loan, full coverage is often a must to protect that asset.

- Financial Protection: New drivers are at higher risk for accidents. Full coverage ensures that if they do crash, the vehicle can be repaired or replaced. Without collision coverage, an at fault accident could total the car and leave the young driver or parents with no car and no payout.

- Cost Saving Strategies: Even though full coverage car insurance for teens is expensive, there are ways to reduce the cost. Most insurers offer a good student discount for high school or college drivers who maintain a B average or better. Teens can also take defensive driving courses to earn discounts. Additionally, consider having the new driver use a modest vehicle a 10 year old sedan will be far cheaper to insure than a brand new sports car or SUV.

- Policy Structure: It’s almost always cheaper to add a teen driver to a parent’s existing policy than for them to get their own policy. As noted above, the cost difference can be thousands of dollars a year. Keep them on the family policy if possible and make sure all vehicles on the policy have appropriate coverage.

For young drivers, full coverage provides important protection, but you’ll need to weigh the cost vs. the benefit. Emphasize safe driving habits early, avoiding accidents and tickets will help their premiums drop over time. As they build experience and reach their 20s, rates will gradually come down. In the meantime, take advantage of every discount available to make full coverage car insurance for new drivers more affordable.

How to Save on Full Coverage Car Insurance

Full coverage offers great protection, but it doesn’t have to break the bank. Smart shopping and taking advantage of full coverage car insurance discounts can significantly lower your premium. Here are some effective ways to save money while keeping robust coverage:

- Compare Quotes from Multiple Companies: Prices for the exact same coverage can vary by hundreds of dollars from one insurer to another. Get full coverage car insurance quotes from at least three reputable companies. Consider big names and local or regional insurers too. A company that’s expensive for your friend might be cheap for you, and vice versa.

- Bundle Your Policies: Many insurers give a multi policy discount if you buy more than one type of insurance from them e.g. auto + home or renters insurance. Bundling can knock 5–25% off your premiums. It’s an easy way to save if you need multiple insurance products.

- Look for Multiple Vehicle or Family Discounts: If you have more than one car in the household, insure them with the same company to get a multi car discount. Likewise, families with multiple drivers might save by all being on one policy.

- Safe Driver Discounts: Maintaining a clean driving record , no accidents or tickets will usually qualify you for safe driver or good driver discounts. Some insurers also offer programs like usage based insurance devices or apps that reward you with discounts for demonstrating safe driving habits.

- Good Student & Defensive Driving Discounts: If you’re insuring a teen or college student, make sure to ask about good student discounts , insurers often cut rates for young drivers who keep a B average or higher. Completing a defensive driving course can also earn a discount for drivers of any age.

- Higher Deductibles: Choosing a higher deductible for collision and comprehensive e.g. $1,000 instead of $250 will lower your premium. Just be sure you could afford to pay that deductible out of pocket if you have a claim. This is a trade off between risk and cost, higher deductible means you’ll pay more in an incident, but you save money every month.

- Ask About Other Discounts: Insurance companies offer a variety of additional discounts. These might include discounts for having anti theft devices or safety features on your car, being claim free for a certain time, signing up for automatic payments or paying in full, being a member of certain organizations or professions, and more. Every insurer has its own list, so inquire and take advantage of any that apply.

- Review Your Coverage on Older Cars: As mentioned earlier, if your vehicle’s value has dropped significantly, you might save by dropping collision or comprehensive coverage. You don’t want to be in a situation where you’re paying $600 a year for extra coverage on a car worth only $3,000. Evaluate periodically using the 10% rule , if the annual full coverage cost exceeds 10% of the car’s value, consider scaling back. Just make sure you could financially handle the loss of the car if an accident happens and you don’t have that coverage.

By combining several of these strategies, drivers can often trim their full coverage premiums substantially. For instance, a good student who bundles auto and renters insurance, drives safely, and uses a higher deductible might save hundreds of dollars a year. Always communicate with your insurance agent or company about discounts, sometimes they won’t apply a discount unless you ask or provide proof like a report card for good grades.

Lastly, remember that shopping around is key. Insurance is a competitive industry, and companies frequently adjust their rates. It’s wise to re shop your policy each time it’s up for renewal to ensure you’re still getting a good deal. Just be sure you’re comparing equivalent coverage levels when you look at quotes.

Choosing a Full Coverage Car Insurance Company

Nearly all full coverage car insurance companies i.e. most major insurers offer similar types of coverage, but they’re not all equal in price and service. Here’s what to consider when choosing an insurer for a full coverage policy:

- Reputation and Reviews: Look at customer reviews and third party ratings for example, J.D. Power satisfaction scores or AM Best financial strength ratings. Reading full coverage car insurance reviews from real customers can highlight how well a company handles claims and customer service. You want an insurer that pays claims fairly and promptly, and treats customers well.

- Price and Discounts: Some companies are simply more affordable for full coverage. According to a 2025 analysis, USAA, Auto Owners, and Geico offer some of the cheapest full coverage car insurance rates on average. However, prices vary for each person, so get quotes. Also consider what discounts each company offers, one insurer might give you a big multi car discount, for example, while another might not.

- Coverage Options: Ensure the company offers all the coverage options you need. Most big insurers allow you to customize liability limits, choose deductibles, and add extras like roadside assistance, rental car coverage, gap insurance, etc. If you have specific needs , say, you want original manufacturer parts coverage, accident forgiveness, or vanishing deductibles, check that your insurer provides those.

- Local Agent vs. Online: Think about your preference for service. Do you want a dedicated local agent you can speak with face to face or on the phone, common with companies like State Farm, Allstate, Farmers, or are you comfortable managing your policy entirely online/via app as with Geico, Progressive, etc.? If you search full coverage car insurance near me, you’ll likely find local insurance agencies that can offer personal guidance and compare multiple companies on your behalf. A nearby agent who understands your community might be helpful, especially if you prefer a more personal touch.

- Claims Service: Ultimately, insurance is about getting help when something goes wrong. Research how each company handles claims. Fast claims processing, 24/7 claims support, and a straightforward claims process are important. Check if the insurer has a reputation for denying claims or if they’re known for hassle free settlements.

Remember, there isn’t a special category of “full coverage insurance companies” almost all insurers offer full coverage policies, from large national brands to smaller regional carriers. The goal is to find one that balances cost, coverage, and service for your needs. Don’t hesitate to ask questions when getting quotes, and consider consulting an independent agent who isn’t tied to a single company. They can provide unbiased comparisons and help you find full coverage that fits your budget.

Full Coverage Car Insurance Summary Table

| Feature | Liability Only | Full Coverage |

|---|---|---|

| Covers damage to others | Yes | Yes |

| Covers your own car | No | Yes |

| Collision damage | No | Yes |

| Theft, fire, weather damage | No | Yes |

| Required by law | Yes (minimum) | No – but often required by lenders |

| Best for | Older, low value cars | Newer, financed, or valuable cars |

| Average annual cost (U.S.) | ~$820 | ~$2,697 |

| Financial protection level | Basic | High |

Final Thought

By now, you should have Full Coverage Car Insurance Explained Clearly, from what it actually covers to how much it costs and how to make it more affordable. Full coverage isn’t a magic bullet that covers everything, but it does provide a critical shield for you and your vehicle in most situations. For U.S. drivers who want solid financial protection on the road, understanding full coverage is key to making the right insurance choice.

In summary, full coverage car insurance means you’re covered not only for damage you might cause to others, but also for damage to your own car from accidents or mishaps. It’s often worth the investment if a big repair bill or the loss of your car would put you in a tough spot financially. Always balance the cost of premiums against the benefit of coverage. And remember, you can optimize your policy by shopping around and tapping into discounts to get the best possible rate without sacrificing protection.

Having the proper insurance coverage brings peace of mind. Whether you’re a new driver or a seasoned one, consider your needs and don’t hesitate to ask questions of insurance providers. With the information from this “Full Coverage Car Insurance Explained Clearly” guide, you’re now equipped to navigate the world of auto insurance with confidence. Drive safe, and stay insured.

References

- Progressive Insurance – Liability vs. Full Coverage Car Insurance

- Bankrate – 2025 Car Insurance Cost Analysis

- Feld Insurance – What Is Full Coverage Car Insurance?

- Teen Car Insurance Cost

Frequently Asked Questions (FAQs)

1. Does full coverage car insurance cover everything?

No. “Full coverage” does not mean every possible situation is covered. It typically includes liability, collision, and comprehensive coverage. It does not automatically cover things like mechanical breakdowns, normal wear and tear, or personal belongings inside the car unless you add extra coverage.

2. Is full coverage required by law in the U.S.?

No. States only require liability insurance. However, lenders and leasing companies usually require full coverage until the vehicle is paid off to protect their financial interest.

3. When should I drop full coverage?

You may consider dropping collision and comprehensive when your car’s value is low and the annual cost of full coverage exceeds about 10% of the car’s value. Only do this if you can afford to replace the car yourself after a loss.

4. Is full coverage worth it for new drivers or teens?

Often yes, especially if the vehicle is newer or financed. New drivers have higher accident risk, and full coverage protects against costly repairs or total loss. To manage costs, parents should add teens to an existing policy and use available discounts.

5. How can I lower my full coverage car insurance cost?

You can save by comparing quotes, bundling policies, choosing higher deductibles, maintaining a clean driving record, applying discounts (good student, safe driver), and reviewing coverage regularly as your car ages.